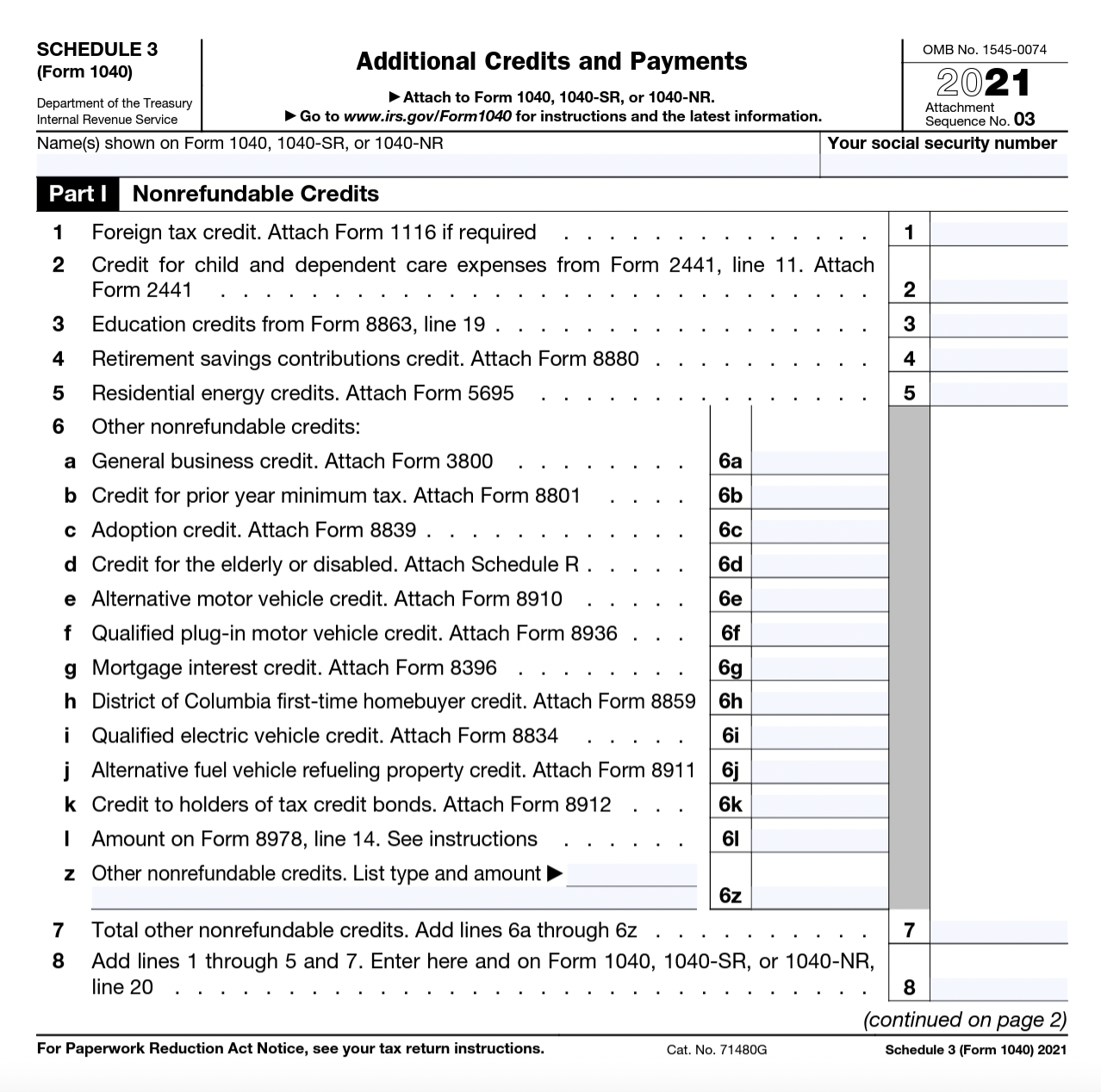

Irs 2024 Schedule 3 Form 2024

2 min readIrs 2024 Schedule 3 Form 2024 – The Tax Relief for American Families and Workers Act of 2024 is currently making its way to the Senate would raise the refundable portion cap of child tax credit from $1,800 to $1,900 to $2,000 each . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

Irs 2024 Schedule 3 Form 2024

Source : www.irs.govIRS Releases Schedule 3 Tax Form and Instructions for 2023 and

Source : www.kxan.comMost commonly requested tax forms | Tuition | ASU

Source : tuition.asu.eduEverything to know before filing taxes in 2024, according to the

Source : www.masslive.com2023 2024 Verification Worksheet Independent by Hofstra

Source : issuu.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govIRS Releases Schedule 3 Tax Form and Instructions for 2023 and

Source : www.kxan.comTax Season 2024: When does tax season starts for 2024? | Marca

Source : www.marca.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comIrs 2024 Schedule 3 Form 2024 Instructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024): The Internal Revenue Service (IRS) has released the tax refund schedule for the year Another change for the 2024 tax season is the elimination of the Form 1040EZ. Taxpayers who previously . With the tax filing deadline coming, you might be wondering about the taxes you will have to pay, but also how your ordinary dividends are taxed. Here’s what you should know about any taxes you might .

]]>